Find the best collateral free loans for business with easy approval and flexible repayment terms.

Hello, fellow entrepreneurs and small business owners. So, you have a dream to start your new venture or expand the existing one. And you are all set to achieve it, but unfortunately, the lack of having any asset to present as collateral for securing a loan is frustrating. Well, here’s some good news for you. Collateral-free loans are here to save your day.

Let’s dive into the wonderful world of collateral-free loans. How they work, what they are, and why exactly they can be the ideal solution for your business needs. So sit back, relax, get a cup of coffee, and let’s get started with this financial adventure!

What Are Collateral-Free Loans?

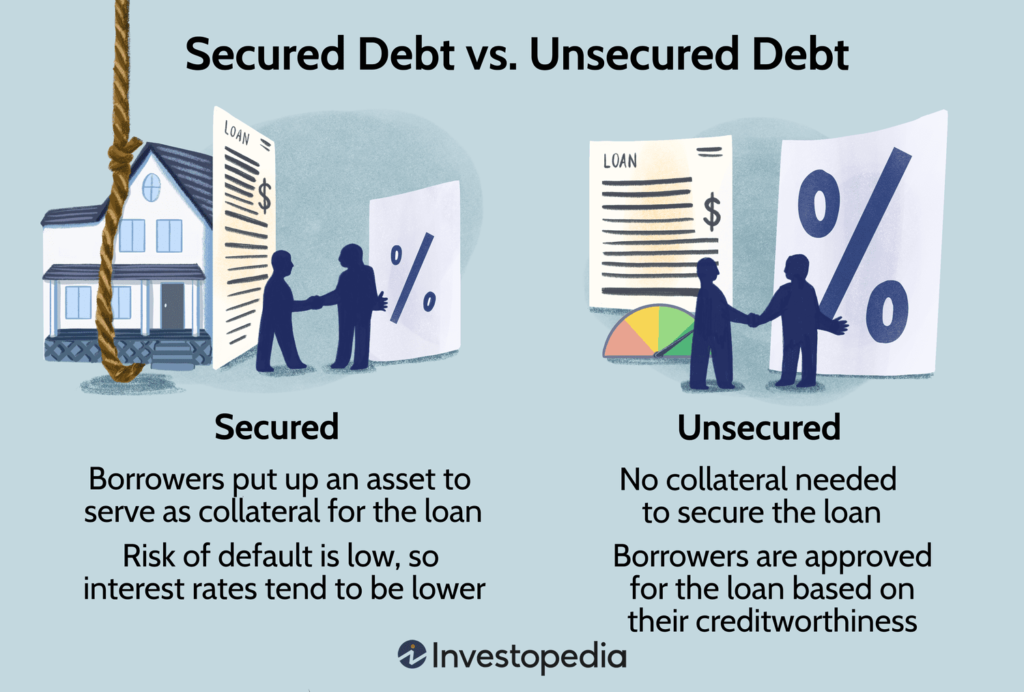

So, let’s just begin with explaining what we mean by “collateral-free loans.” In simple terms, these are loans you can have without the need to pledge an asset for a guarantee. No need to put your house or car or family heirloom behind it, okay?

Traditionally, when you’re applying for a business loan, the banks ask for a piece of collateral. That could be property or equipment or another valuable asset. If they cannot recover the amount owed, they can seize these assets. In this case, collateral-free loans will not put any specific assets on the line.

Well, you may be asking, “Are collateral-based business loans necessary?” Not at all! Increasingly these days, entrepreneurs are choosing no-collateral business loans, especially startups or small and medium enterprises.

Why Are Collateral-Free Loans Good for Entrepreneurs?

1 Less Risk: You’ll not stake your personal assets on the line. This makes you feel comfortable as you expand your business.

2. Low Collateral is Needed: Most small entrepreneurs, especially the novices, possess virtually no assets that may be offered as collateral. The absence of this forbids the use of borrowing.

3. Quick Processing of Loan: Since it is not necessary to appraise and document the collateral, the loan can be processed quicker in most cases.

4. For any New Venture or Expansion: Collateral-free loans can be taken to start any new venture or for expanding an existing venture

Types of Collateral-Free Loans for Entrepreneurs

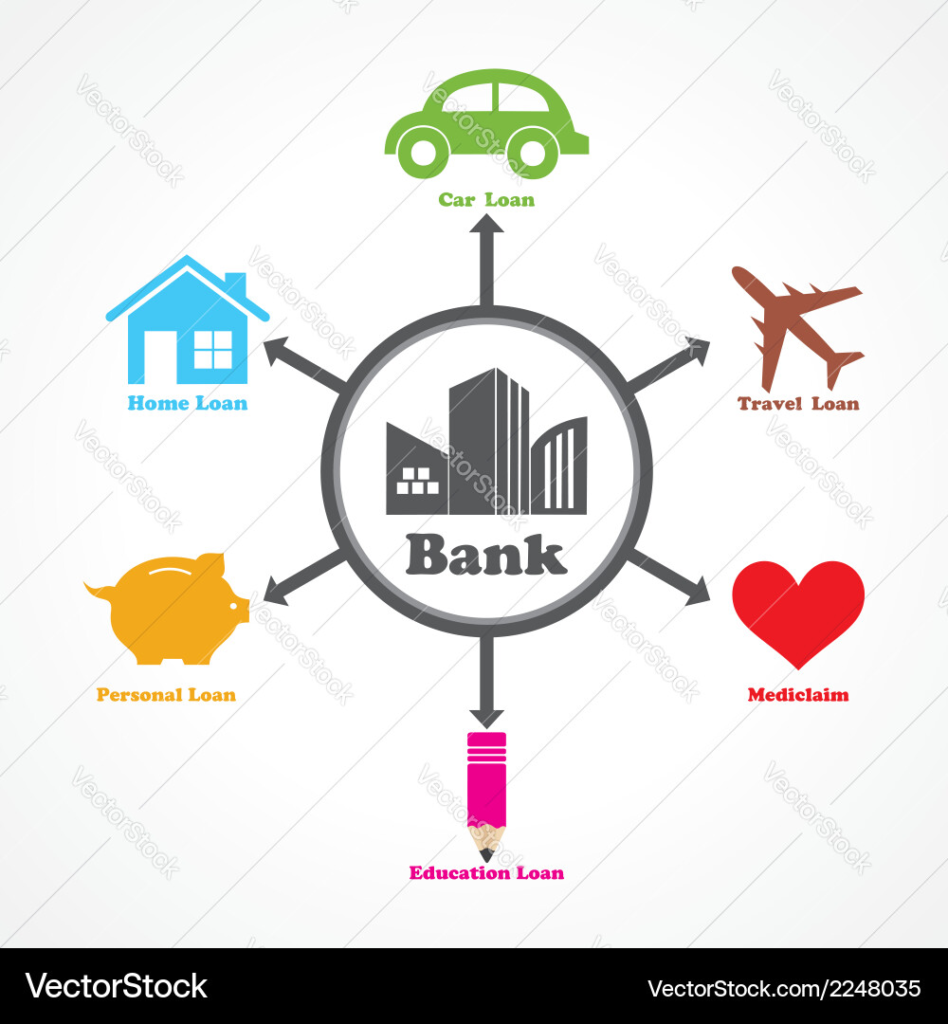

Now that we know why collateral-free loans are so cool, let’s have some specific types you could face:

1. Collateral-Free Loans for Startups

If you recently began your entrepreneurial journey, then loan for startups that do not require any collateral may be ideal for you. These specific loans are tailored for new businesses that haven’t been in existence for long and do not possess any valuable assets.

2. The MSME sector is an integral part of our economy. Understanding this, a number of governments and institutions have collateral-free loans for MSMEs. These are a saviour for small businesses seeking growth.

3. Collateral-Free Working Capital Loan

Need funds to cover daily expenses? A collateral-free working capital loan is here to save the day. These help manage cash flow or pay off suppliers or operational costs without pledging any assets.

4. Collateral-Free Loans for Women Entrepreneurs

Ladies only! For those who matter, several lenders have already created special collateral-free loan programs targeted especially for women entrepreneurs. These loans target to encourage more women to venture into the world of business, and they provide them with financial support.

How to Get a Business Loan Without Collateral

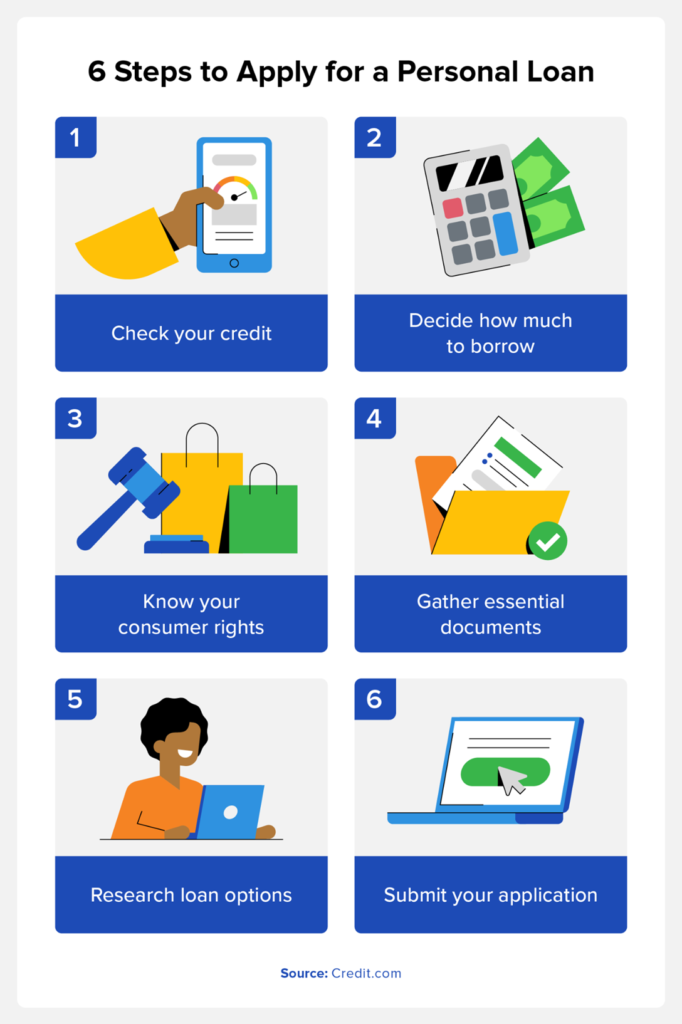

Well, now you must be thinking: “All this sounds great, but how do I get one of these loans?” Not a problem, as I will outline a step-by-step guide on how to get a business loan without collateral.

1. Check Your Credit Score: Although there is no collateral, there is still a check of the credit history given to you. See that your credit score is in good shape.

2. Business Plan: Make clear the vision and strategy of your business to lenders.

3. Organise Financial Documents: Compile all tax returns, bank statements, and financial projections into a ‘package’.

4. Find Lenders: Look for banks and other financial institutions targeting collateral-free loans specifically for your type of business.

5. Compare: Do not immediately take the first offer that comes your way. Compare interest rates, terms, and conditions between lenders.

6. Apply: Once you have determined which loan best suits your business, fill out the application. Be as open and honest in furnishing all details.

7. Follow Up: Stay in regular communication with the lender and provide any additional information demanded of you in a timely manner.

Which Types of Property Are Acceptable to Secure a Business Loan?

Now you may be thinking, “Alright, alright, if I do end up needing to collateralize, then what can I use?” It’s always good to know your options, even though we are concentrating on these collateral-free loans. These are some of the most common forms of collateral for business loans:

– Real estate: commercial or personal

– Equipment or machinery

– Inventory

– Accounts receivable

– Cash savings or deposits

– Personal assets (like cars or valuable collections)

But forget all those with collateral-free loans!!

Most In-Demand Collateral-Free Loan Options

Now, here are some of the specific loan options you might face:

HDFC Bank Collateral-Free Loan

HDFC bank provides a business loan up to certain amounts of amount to the existing businesses with its collateral-free business loan option. These loans may be given in order to expand your operations.

Zero Collateral Loans

Others are offering what they claim are “zero collateral loans.” That’s essentially collateral-free loans: you don’t have to provide any assets as collateral.

High Value Collateral-Free Loans

Believe it or not, you can get significant amounts of collateral-free loans. Certain lenders are offering 2 crore loan, without collateral, or even 5 crore loans without collateral based on your business’ current health and potential.

Pros and Cons of Collateral-Free Loans

Like everything in life, collateral-free loans have their pros and cons. Here are the cruxes:

Pros:

– No risk to personal assets

Easier to obtain for new businesses

Fast processing times

Flexibility in the use of funds

Cons:

– Usually at a more expensive interest rate

Smaller loan sizes as compared to secured loans

Tougher eligibility

Personal guarantee may be required

Tips for Acquiring a Collateral-Free Loan

Want better opportunities at getting approved with a collateral-free loan? Here’s the top three ways to do that:

1. Better Credit Score: The higher your credit score is, the more probable it is to get better terms or interest rates.

2. Strong Cash Flow: The Lenders want to have assurance that you can generate more cash back into the business in order to repay the loan.

3. Good Business Plan: A well-thought-out business plan is a proof of potential in a business.

4. Consider Co-Signer: If you have a good credit score, then having co-signer might improve your chances.

5. Start Small: Once you start, then many people start small to get accustomed to the lender and to earn trust from them.

FAQs About Collateral-Free Loans

Let’s answer the most frequently asked questions about collateral-free loans:

Q: How can you get a business loan without collateral?

A: Of course! Many lenders offer unsecured business loans, mainly for the startup as well as the smaller entities.

Q: What is an unsecured MSME loan?

A: It means the loan is provided to Micro, Small, and Medium Enterprises without accepting any security in terms of assets. Most such lending happens through government schemes to foster entrepreneurship.

Q: Is the MSME loan collateral-based?

A: No, because many MSME loan programs are designed to be collateral-free, such that small enterprises can get access to a source of finance easily without putting up collateral.

Q: What must one qualify for a collateral-free loan to start a new business?

A: Look for lenders that focus on financing startups, develop a strong business plan, and be prepared to demonstrate what will help you generate revenue to repay the loan.

Conclusion: Empowering Entrepreneurs with Collateral-Free Loans

And there you have it, folks – the all-inclusive guide to collateral-free loans for entrepreneurs! Whether it is a dream startup, expansion of your existing venture, or working capital for MSMEs, in most cases, collateral-free loans can indeed be a game-changer.

Remember, these loans are bound to facilitate the dreams of entrepreneurs like you to turn them into reality. They remove valuable assets as a barrier, allowing people with different experience and age ranges to access the necessary funding to grow and be successful.

As is the case with all such financial decisions, research is a must. Compare various loan offers, read in their fine print, and see what the terms and conditions are before finally putting your signature on the dotted line.

Well, are you ready to take your business to the next level? With collateral-free loans, there is no limit! Come on; crunch those numbers, polish that business plan, and take the leap. Your entrepreneurial journey awaits, and now you have one more tool in your financial toolkit to help you succeed.

Cheers for good fortune, future entrepreneurs. Here’s to hoping that your endeavours turn profitable, your ideas innovative, and your collateral-free loans approved!